Pulling back the curtain on a Minimum Wage Increase

October 30, 2017 - The minimum wage debate has always been a fierce and passionate one, and understandably so, as it has very direct impacts on many individuals’ lives. The general arguments in favour of raising the minimum wage are that it would put money in the pockets of workers, lifting many out of poverty, without many negative impacts on the economy or labour market. Conversely, the arguments against are that any increase to the minimum wage will result in a significant number of job losses, a push towards increased automation, and subsequently, push more people below the poverty line as businesses let employees go in order to sustain their operations. A review of the evidence would suggest that both of these views are on some level incorrect, but do contain some traces of truth.

To understand the impacts that a raise in the minimum wage has on society it is important to first understand some facts about who actually earns the minimum wage. A report written for Northern Policy Institute by Dr. Morley Gunderson, using 2003 data, states that 60 per cent of all minimum wage earners are teens (ages 15-19) or youth (ages 20-24) who are not living independently. Another 11 per cent of total minimum wage earners are youth living with roommates (not with spouses or partners), often with other college or university students. Additionally, 18 per cent of those receiving minimum wage live with someone who earns more than the minimum wage, meaning that the household is not solely supported by this salary. Furthermore, only 6 per cent of these low wage earners live with a partner or spouse that does not earn more than minimum wage and only 4 per cent are the sole income earner for the household. A more up to date 2016 report by the Fraser Institute found similar statistics, noting that close to 58 per cent of minimum wage earners are teens and youth, and only 2.2 per cent are the sole income earner for a household or family. Interesting, the Fraser report also found that 87.5 per cent of Canadians earning minimum wage live in households above the low income cut-off.

It is interesting to note however, that a 2017 report from the Canadian Centre for Policy Alternatives (CCPA) determined that the number of teens and youth earning minimum wage has fallen from 58 per cent to 42 per cent. However, this decrease may appear more extreme than it actually is for two reasons. First, the CCPA report may be using slightly distorted evidence because it only takes into account employment between the months of January and June. Many youth would still be in school for the majority of this time and not looking for work until the year is finished, which may contribute to the lower number. Second, in recent years the youth labour force participation rate has been falling, meaning that less youth are looking for jobs altogether. Most (70 per cent) of the decrease in the participation rate for those aged 15-19 is a result of lower participation among high school students and 57 per cent of the decline for those aged 20-24 is attributable to those enrolled in post-secondary schooling. In turn, less students are taking on jobs while they are in high school and as they work towards their diploma or degree. Additionally, the youth unemployment rate is 2.3 times higher than the unemployment rate for those 25 and older. Thus, not only are fewer youth looking for employment, those that choose to seek employment are facing challenges in finding work.

Overall, the evidence above highlights that most minimum-wage workers are not living in poverty; rather, they are youth who are not financially supporting themselves, or are living with someone else who is the primary income earner. This makes the increase in minimum wage an ineffective poverty reduction tool on its own as raising the minimum wage will have the greatest impacts on youth, and not adults in the workforce.

Effects on Youth Employment:

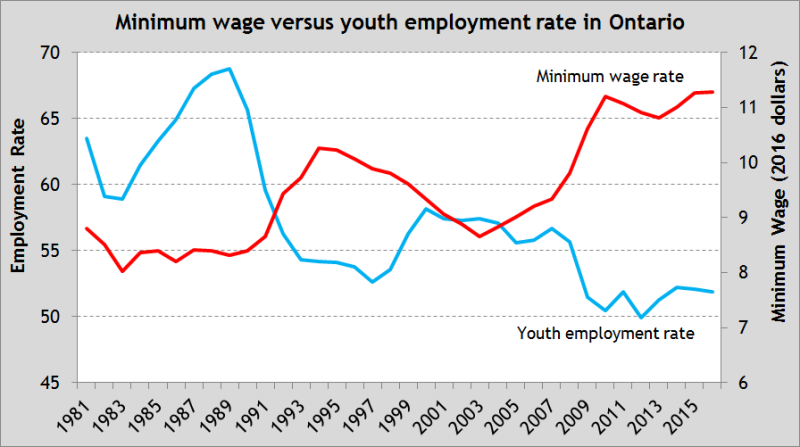

Historically, increases in minimum wage have had some unintended adverse effects on youth employment in Ontario. The graph below, from Fraser Institute, shows there is a negative correlation between the minimum wage and the youth employment rate in Ontario. Fraser Institute did state, however, that this graph does not take into account broader factors such as the economic downturn. As well, a report using American data found that drops in overall employment were more closely linked to recessions rather than minimum wage hikes. It is important to remember that the United States and Canada are not necessarily the same; however, we must keep in mind that recessions do have impacts on the labour market. Thus, past evidence tells us that raising the minimum wage will have some negative effects on the level of youth employment, and it also tells us that recessions will amplify these effects.

What this means for youth: With less youth able to find employment there will be a growing gap between youth who “have” and youth who “have-not.” Those who can find work will make more money than they did previously, but some will be unable to find employment and collect an income. This may not seem like an issue as most youth in Ontario are not living independently – in fact, according to 2016 Census, 62.6 per cent of those aged 20-24 live with their parents. Furthermore, the 2011 National Household Survey found that 90 per cent of youth living with their parents claimed to have “no responsibility” for any expenses at home. Also, for those who are working and going to school, this wage level is likely temporary- but there are longer term effects to consider. The youth who cannot find a job may miss out on valuable workplace skills and opportunities that may help them advance to higher pay work in the future. In extension, those who are able to earn an income and gain work experience may have a head start over those who cannot.

Effects on price levels:

Prices of many goods may increase with the minimum wage as businesses pass on the added cost to consumers, especially for small businesses with slimmer profit margins. However, Armine Yalnizyan, Senior Economist at the CCPA, mentioned that 50 per cent of minimum wage earners work for companies with 500 or more employees. Yalnizyan argues that these large enterprises do not need to raise prices to cover the cost of paying higher wages as they can afford to have smaller profit margins if it means bringing in more businesses.

What this means for consumers: Those who like to shop at small, local businesses may see some higher prices. However, as larger corporations may not need to increase prices, there still will be a cheaper alternative for many consumers. The choice between prices means consumers will not necessarily be hit with more expensive bills, but that it is possible that more consumers would choose larger corporations over small businesses.

Effects on Businesses:

The restaurant industry will likely be more effected by a minimum wage increase than other industries as restaurants tend to employ lower wage workers. Restaurants Canada claims that a wage increase of 32 per cent in the next 18 months, what is currently being proposed in Ontario, would cost an average restaurant an additional $47,000 a year; however, the average profit margin for this businesses is only $23,450.

What this means for businesses: Restaurants will need to charge higher prices or cut jobs and/or hours to continue profiting. This will have negative effects on the customers and on staff who may lose their jobs. Additionally, as mentioned in the previous section, small businesses may struggle to compete with larger companies who will not have to adjust their prices in the same way as the small businesses will. This means small businesses may have to shut down as they may lose customers to big companies.

Effects on the Economy:

As a whole, there is no evidence to suggest the economy will be extremely influenced either way by a minimum wage increase. More money in the pockets of minimum wage earners means that they will have more to spend, which will help drive the economy as 57 per cent of Canada’s GDP comes from household spending. Conversely, there will be negative effects on the economy stemming from struggling businesses who may be forced to increase prices and/or lay off employees. Overall though, these effects essentially offset each other resulting in negligible impacts, as the U.S. Congressional Budget Office found in a report pertaining to Federal wage increases.

In sum, there are obvious benefits and unintended microeconomic consequences that come with a raise to the minimum wage. In other words, the effects of adjustments to a minimum wage will impact the everyday lives of specific workers and specific businesses. However, as a whole, there is no evidence to suggest raising the wage will drastically alter the economic outlook of the province.

How governments should respond:

It is apparent that raising the minimum wage comes with both benefits and consequences and the government should take into account all of these effects before making any decisions. Even though the overall macroeconomic effects of these changes tend to be negligible, it is still important for the everyday lives of Ontarians to manage the adverse effects of a minimum wage increase. Below are three proposals for minimum wage policy in Ontario.

- The government should ensure that changes to the minimum wage are small, incremental changes, heading to a provincial goal (presumable $15/hour), rather than making large changes in a short timeframe. These changes should also be “pre-set” and established in a well-advanced schedule so that businesses have proper time to prepare.

- The government should consider linking minimum wage increases to the state of the economy, similar to what has been done in California, where the minimum wage is set to reach $15 by 2023. The California approach allows the government the flexibility to halt the pre-set increases to the minimum wage in times of economic downturn.

- After the government has met its target wage, it would be beneficial to set the minimum wage to change at the same rate as inflation; but still allow for those changes to be postponed by the government when the economy is in recession. This would ensure that the purchasing power of those earning minimum wage is always steady and that they do not become worse off in the future. Also, this would provide businesses with predictable changes to the wage, helping to minimize the adverse effects of minimum wage increases.

Eric Melillo is a former Policy Intern at Northern Policy Institute.

The content of Northern Policy Institute’s blog is for general information and use. The views expressed in this blog are those of the author and do not necessarily reflect the opinions of Northern Policy Institute, its Board of Directors or its supporters. The authors take full responsibility for the accuracy and completeness of their respective blog posts. Northern Policy Institute will not be liable for any errors or omissions in this information, nor will Northern Policy Institute be liable for any detriment caused from the display or use of this information. Any links to other websites do not imply endorsement, nor is Northern Policy Institute responsible for the content of the linked websites.

Northern Policy Institute welcomes your feedback and comments. Please keep comments to under 500 words. Any submission that uses profane, derogatory, hateful, or threatening language will not be posted. Please keep your comments on topic and relevant to the subject matter presented in the blog. If you are presenting a rebuttal or counter-argument, please provide your evidence and sources. Northern Policy Institute reserves the right to deny any comments or feedback submitted to www.northernpolicy.ca that do not adhere to these guidelines.